Market Commentary | January 27th, 2025

Market Commentary | January 27th, 2025

Week in Review…

As the new president took office this past week, headlines were dominated by the potential impact of campaign promises turning into executive actions.

- The S&P 500 ended up 1.74%

- The Dow Jones Industrial Average led major indices up 2.15%

- The tech-heavy Nasdaq finished up 1.65%

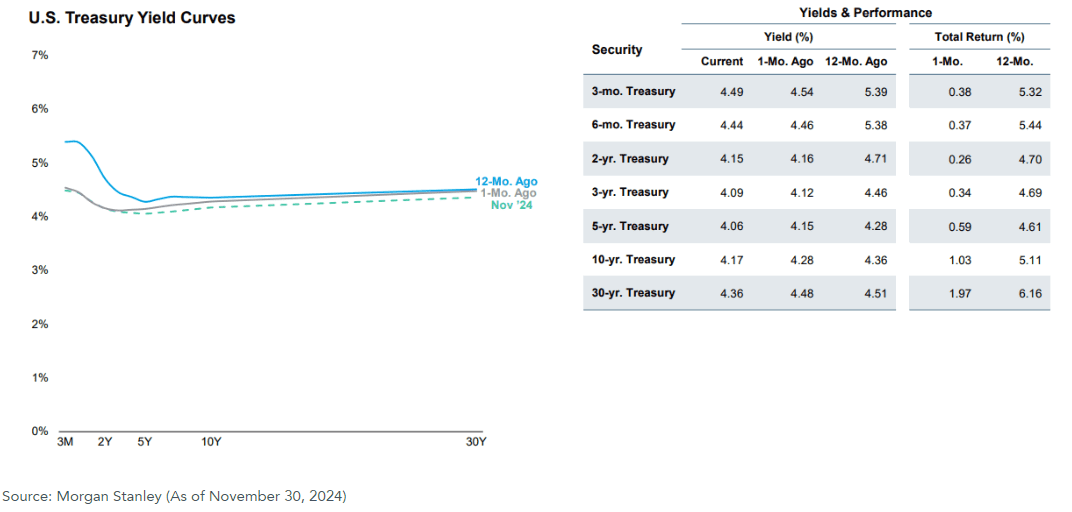

- The 10-Year Treasury yield concluded at 4.59%

Financial markets responded by actively assessing which sectors stand to gain or lose in the new political landscape, with particular scrutiny on the effects of potential tariffs. However, amidst this political focus, important economic data also emerged, offering insights into the underlying health of the economy.

Strong Corporate Earnings: Several major corporations reported strong Q4 earnings this week, exceeding analysts’ expectations. Streaming services, for example, saw a significant gain, driven by the addition of new subscribers.1 Major banks outperformed Q4 expectations and capped off a strong earning season, reflecting continued strength within the banking sector.

Mixed Signals in Demand: While the housing market showed positive signs with December’s Existing Home Sales exceeding expectations for the third consecutive month, indicating robust consumer spending, the oil market presented a contrasting picture. Crude oil inventories fell short of analyst forecasts for the fourth consecutive week, suggesting sluggish oil demand and potentially weaker overall economic demand.

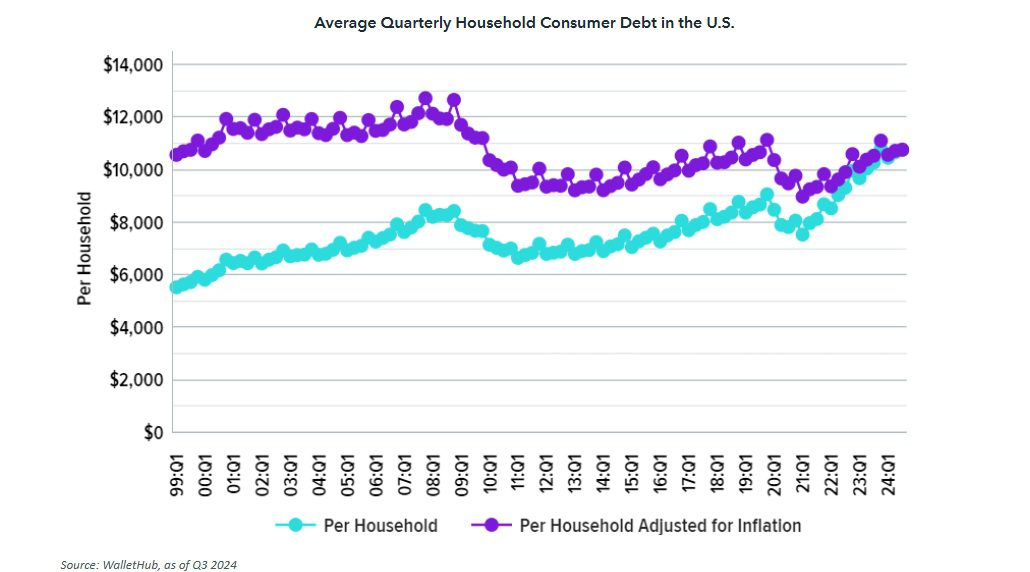

Softness Around the Edges: Despite these positive earnings reports, some economic indicators revealed areas of concern. The labor market showed signs of weakness with both Continuing and Initial Jobless Claims exceeding expectations for the second consecutive week. This warrants close monitoring for potential labor market softness and rising unemployment. Furthermore, consumer sentiment weakened as indicated by softer-than-expected preliminary Services Purchasing Managers’ Index (PMI) data and disappointing Michigan Consumer Expectations and Sentiment data. Markets will closely analyze this data as it may signal a weakening consumer.

Spotlight

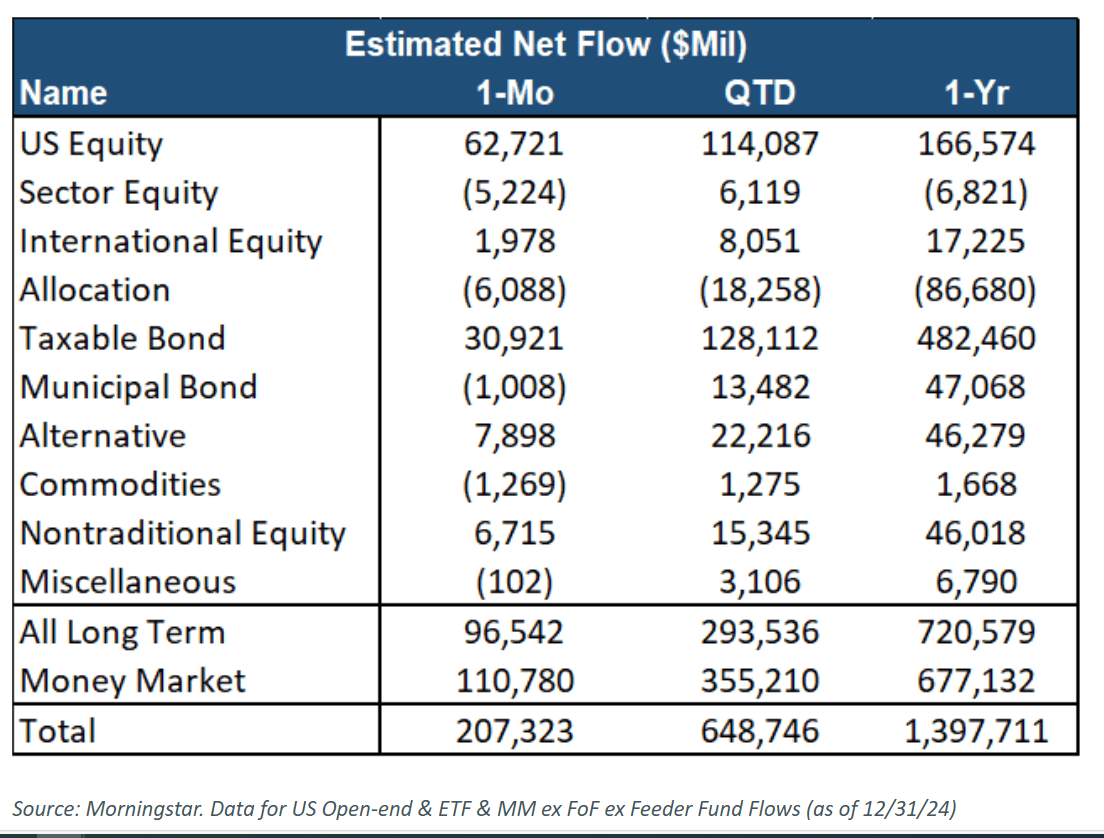

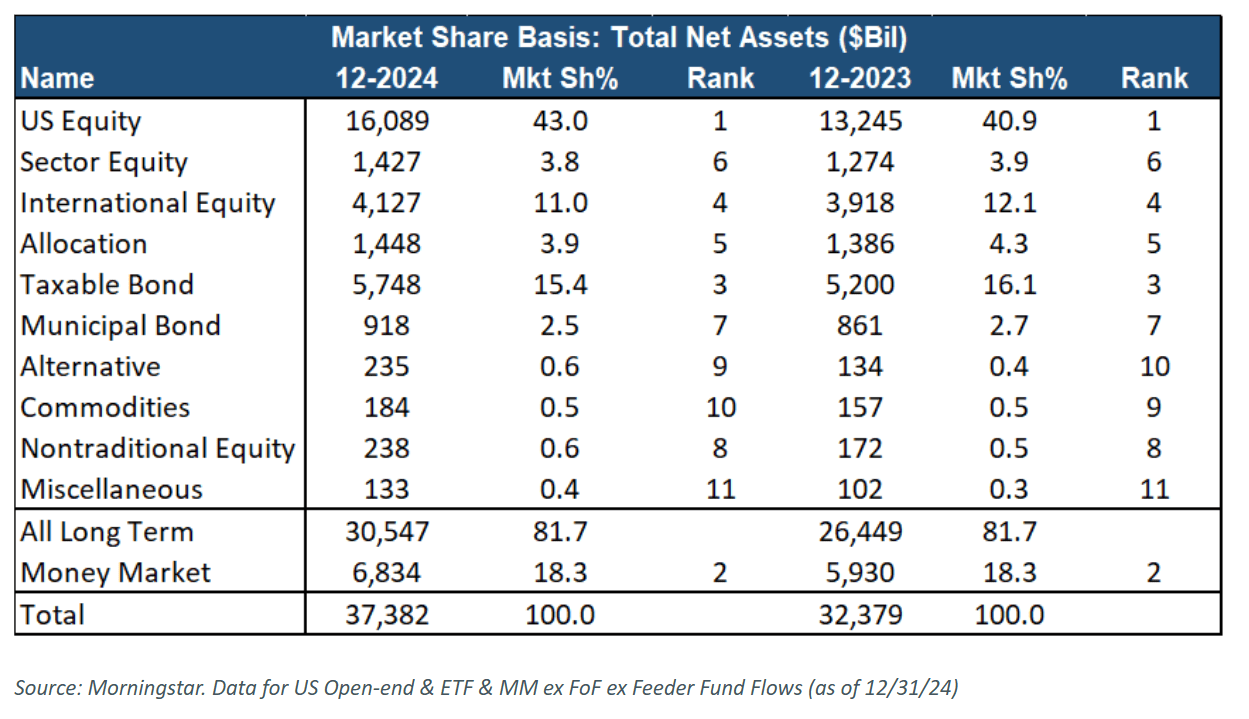

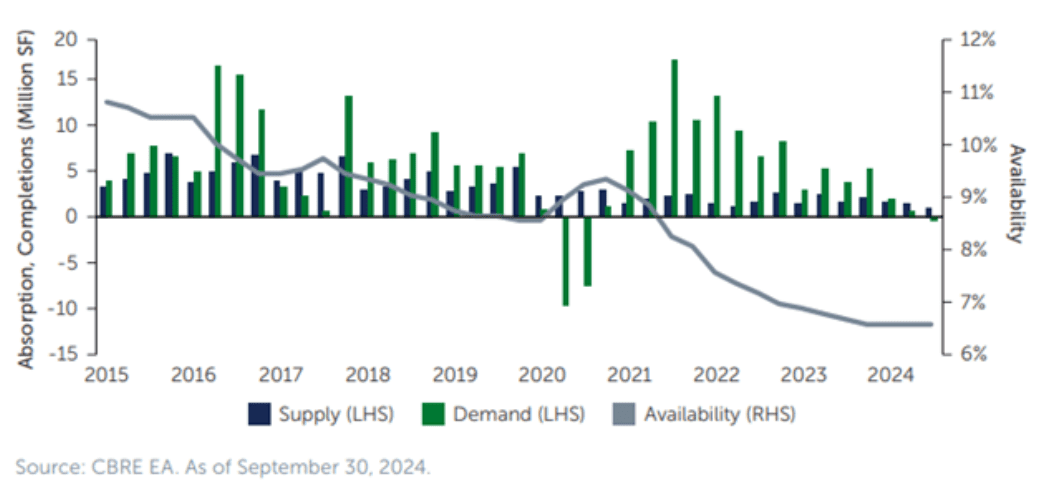

A Look at Q4 Fund Flows

With January starting off strong for equities, we take a look back at last quarter and summarize fund flows into mutual funds and ETFs to see where investors have positioned for 2025.

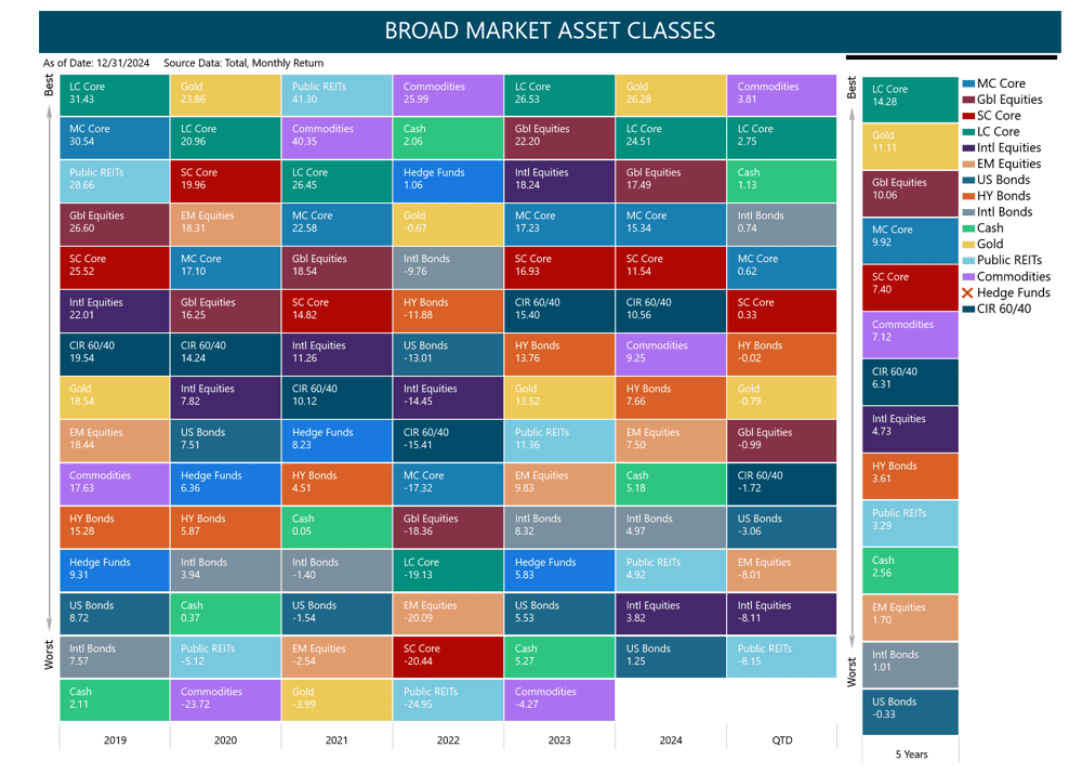

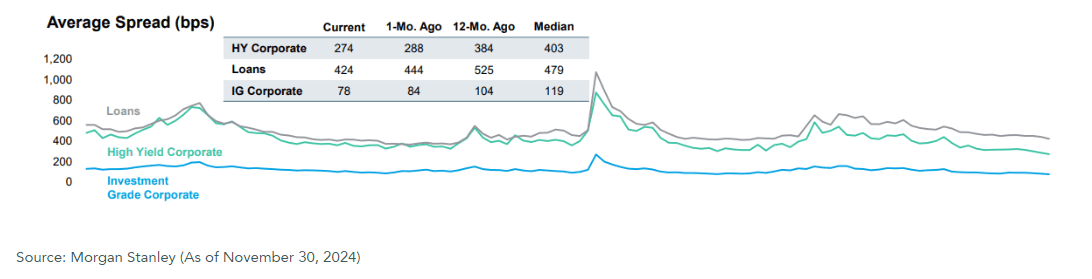

Flows for 2024 were positive for risk assets, as flows to U.S. equity mutual funds and ETFs took in over $166 billion. With broad concerns about slow growth and home country bias, international equities took in only $17 billion for the year. In bonds, taxable bond flows were the big winner taking in over $482 billion in flows as investors looked to lock in higher yields as the Fed continues its rate cutting regime. Despite the flows to risk assets, money markets took in nearly $677 billion as a whole or 48% of every dollar invested into mutual funds and ETFs. This indicates that investors may still be hesitant to allocate to risk assets. The most interesting takeaway is that 68% of flows into equities came in Q4, which could be indicative of investors’ hopes for stocks in 2025.

In 2024, global equities as a whole grew to $20 trillion, up from $17 trillion at the end of 2023. Specifically, U.S. equities rose to $16 trillion from $13 trillion at the end of 2023, and currently account for 43% of all long-term assets. Despite strong positive flows in 2024, taxable bonds fell on a market share basis from 16.1% to 15.4%. Another surprise for 2024 was the growth in alternative funds, as the asset class grew by $100 billion from $134 billion.

Moving forward, as the economic backdrop has created tailwinds for risk assets, investors have been positioning equities as the asset class to be in for 2025.

Week Ahead…

Next week, we will have quite a busy week in economic data releases. On Tuesday, we will receive the consumer confidence data from the Conference Board; however, this reading likely will only partially capture the impact of the new administration. The market will be looking for signs of how consumer sentiment is evolving amidst recent policy changes and ongoing economic conditions.

On Wednesday, the Federal Open Market Committee (FOMC) will hold its meeting, and market expectations are leaning towards the Fed maintaining the current federal funds rate. Given the recent inflation data, a resilient job market, and the influence of the new administration, the consensus believes the Fed will opt for a wait-and-see approach.

On Thursday, we will receive the 4Q 2024 gross domestic product (GDP) report and initial jobless claims. The GDP report will provide insight into the overall economic growth, helping market participants gauge the strength of the economy. Meanwhile, initial jobless claims will shed light on the health of the labor market, indicating whether layoffs are increasing or if employment conditions are stabilizing. Lastly, on Friday, the Personal Consumption Expenditure (PCE) Index and Chicago PMI data will be released. The PCE data is crucial for understanding inflation trends, as it is the Fed’s preferred measure of price changes. Meanwhile, the Chicago PMI will provide insights into manufacturing activity in the region. These indicators will be essential for gauging inflationary pressures and overall economic momentum, influencing market sentiment and expectations for future Fed actions.

1Kessel, Andrew. “Netflix Stock Pops on Higher Revenue Outlook, $15B Buyback Boost.” Investopedia, January 22, 2025. https://www.investopedia.com/netflix-earnings-q4-fy-2024-8777613.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.