Market Commentary | April 21st, 2025

Weekly Market Commentary

April 21st, 2025

Week in Review…

U.S. equities experienced a downturn last week, reversing the sharp gains from the previous week. Both the S&P 500 and Nasdaq indices have now fallen for the third time in the last four weeks. Treasuries strengthened, leading to a steepening of the yield curve. For the week ending, April 18:

- The S&P 500 declined by -1.50%

- The Dow Jones Industrial Average fell by -2.66%

- The tech-heavy Nasdaq dropped by -2.62%

- The yield on the 10-Year Treasury rose to 4.34%, up from 4.10% at the end of the previous week

Due to the observance of Good Friday, this week had fewer economic data releases.

On Wednesday, retail sales data revealed a significant 1.4% increase in U.S. retail sales for March. This surge is largely due to consumers rushing to purchase vehicles before the 25% global car and truck tariffs took effect in early April. This follows a modest 0.2% rise in February. However, economic concerns are impacting discretionary spending, with high-income households continuing to drive spending while low-income consumers struggle.

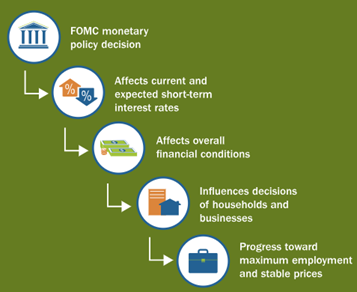

The Federal Reserve delivered a speech on April 16, highlighting the potential for future interest rate adjustments and ongoing volatility in the bond market. Investors are closely monitoring U.S. Treasury yields, which have experienced increased volatility in recent weeks. The Fed’s comments have heightened speculation about the direction of monetary policy, contributing to market uncertainty and affecting global financial markets.

Spotlight

Secondaries Private Equity Market

Private equity (PE) involves investing capital in private companies in exchange for ownership. These companies are not publicly traded, and the capital typically comes from institutional and accredited investors, either directly or through managed funds. Unlike public equity, PE investments are long-term and illiquid. Broadly, as an asset class, PE encompasses various strategies, including venture capital, growth capital, buyouts, and secondary fund of funds investments.

Secondary private equity investments, or secondaries, involve purchasing existing stakes in PE funds from current investors. This market allows buyers to acquire mature, diversified portfolios, often at a discount, providing liquidity to the original investors. Transactions can include direct purchases of fund interests from limited partners (LPs) and general partners (GPs). Secondary-focused PE funds specialize in this market.

Initially, secondary investments offered liquidity to constrained LPs in a niche market with few buyers, stressed sellers, and steep discounts. Today, the secondary PE market is more about strategic portfolio realignment. The growth of the primary PE market has increased the volume of assets available for resale. The market now includes sophisticated entrants like pension funds, sovereign wealth funds, family offices, endowments, foundations, and private wealth intermediaries.

Economic volatility in public equities can create a compelling entry point for investors, driven by the denominator effect, where public pension funds are overallocated to alternative investments due to decline in public market positions. Secondary transactions help investors reduce GP relationships, comply with regulatory changes, and adjust allocation mandates. As institutional investors reduce PE exposure, new investors can purchase these positions at discounts.

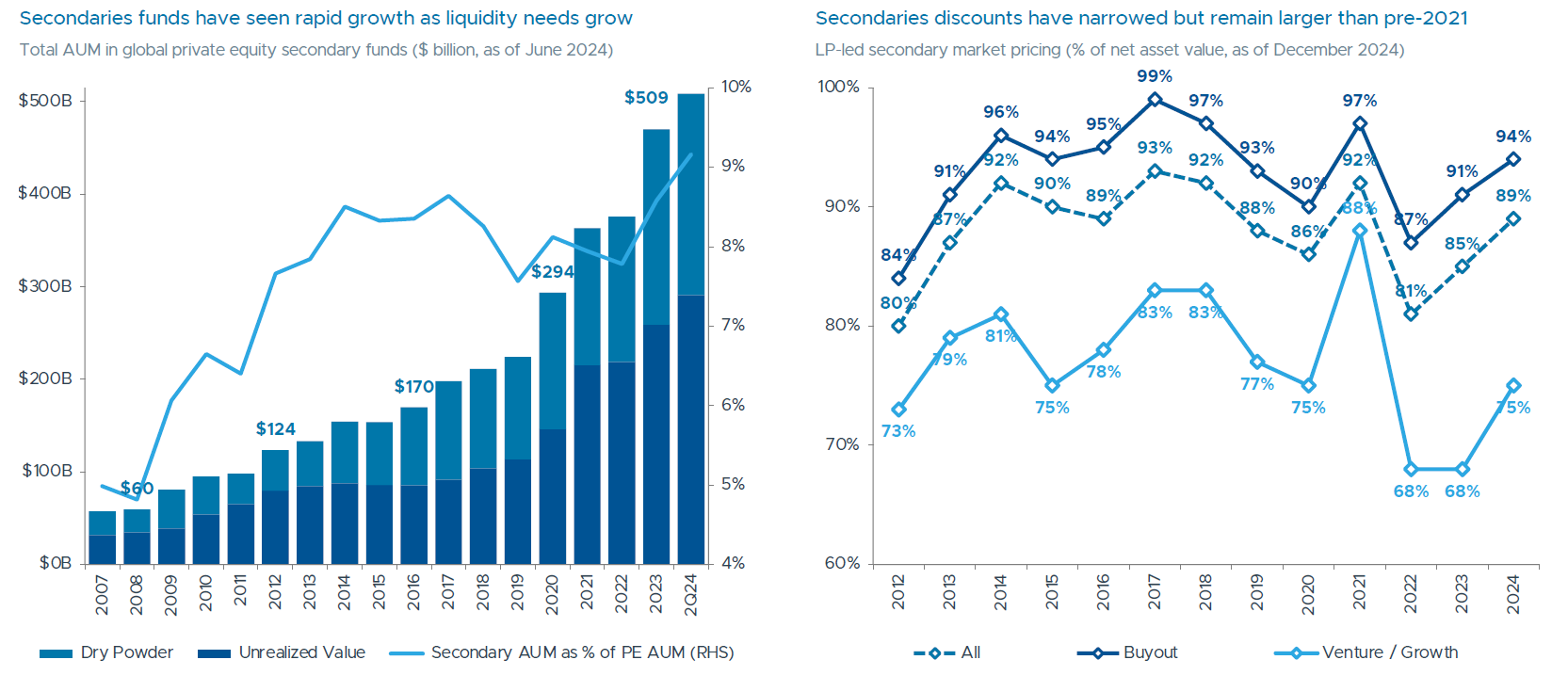

Semi-liquid open-end tender fund structures have enabled accredited investors and qualified clients to access this growing market. Since 2010, PE secondaries assets under management have quadrupled, reaching nearly $509 billion by the end of 2024.

Source – Preqin, iCapital

(click image to expand)

However, investors should weigh the benefits and risks before deciding to allocate to this asset class.

Benefits and Risks of Secondary PE Investments

Benefits:

- Mitigation of the J-Curve Effect: Secondary investments can help mitigate the initial negative cash flow pattern typical of PE funds.

- Liquidity: Provides liquidity to original investors by allowing them to sell their stakes.

- Diversification: Buyers can acquire mature, diversified portfolios, often at a discount.

- Reduced Blind Pool Risk: Investors gain immediate exposure to established assets, allowing for more informed investment decisions.

- Discounted Entry: Secondary investments are often acquired at a discount, potentially enhancing returns.

Risks:

- Valuation Uncertainty: The valuation of secondary PE assets can be complex and may not always reflect current market conditions.

- Market Volatility: Secondary markets can be affected by broader economic conditions, impacting the value of investments.

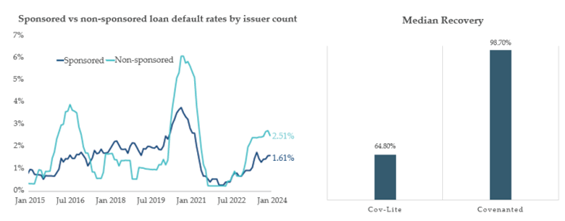

- Manager Performance: The success of secondary investments heavily depends on the skill and experience of fund managers.

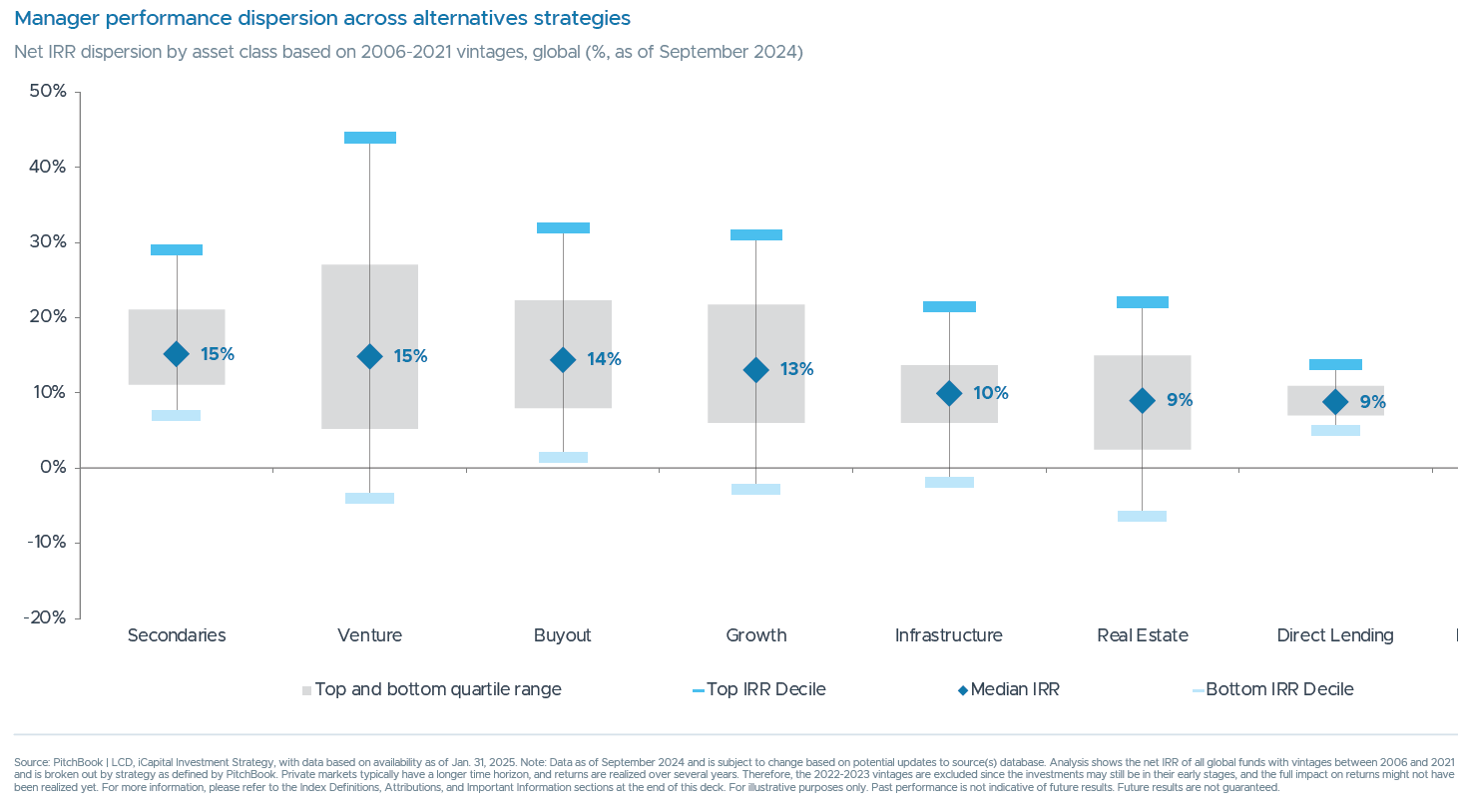

Source – Pitchbook, iCapital

(click image to expand)

Manager Selection and Evergreen Funds

Choosing skilled managers is critical in the secondary PE market due to the significant performance gap between top and bottom quartile managers.

Evergreen semi-liquid funds, such as interval and tender offer funds, now provide continuous access to private equity investments without a fixed end date. These funds pool capital from sophisticated investors to invest in a diversified portfolio of private companies. Unlike traditional closed-end funds, evergreen funds are open-ended, offering easier access to private market investments with lower minimum investments, a semi-liquid structure, and immediate exposure to the asset class.

The secondary PE market offers active opportunities for investors seeking liquidity, diversification, and potentially higher returns. However, it requires careful consideration of the associated risks and the selection of skilled managers. The advent of evergreen funds has democratized access to PE, allowing a wider range of investors to participate in this lucrative market.

Financial professionals are required to undergo additional training mandated by Cambridge and must adhere to Cambridge’s concentration guidelines when considering secondary PE funds for their clients.

Week Ahead…

The upcoming week is filled with significant economic data releases, starting with the Manufacturing Purchasing Managers’ Index (PMI), Services PMI, and New Home Sales.

The Manufacturing PMI and Services PMI are crucial indicators of economic health, measuring the activity levels of purchasing managers in the manufacturing and services sectors, respectively. These indices provide early insights into business conditions, helping investors and policymakers assess the strength of economic growth and potential inflationary pressures. New Home Sales data reflects the number of newly constructed homes sold in the previous month. This is a vital indicator of the housing market’s health and consumer confidence, as strong sales suggest robust demand and economic stability.

Towards the end of next week, we will see the release of Existing Home Sales and Durable Goods Orders. Existing Home Sales data provides a snapshot of the housing market’s performance, indicating the volume of previously owned homes sold during the month. Durable Goods Orders measure new orders placed with manufacturers for goods expected to last at least three years, such as appliances and vehicles.

J-Curve: In private equity, the J-Curve illustrates the typical pattern of investment returns. Initially, returns are negative due to upfront costs and fees. Over time, as investments mature and generate profits, returns increase significantly, forming a “J” shape. This reflects the transition from early losses to substantial gains as investments are successfully realized.

Blind Pool Risk: This refers to the risk associated with investing in a fund where the specific investments are not disclosed beforehand. Investors rely on the fund manager’s expertise and prior track record without knowing the exact assets or companies their money will be invested.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.

An alternative investments strategy is subject to a number of risks and is not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risk associated with such an investment. Certain risks may include but are not limited to the following: loss of all or a substantial portion of the investment, short selling or other speculative practices, lack of liquidity, volatility of returns, absence of information regarding valuations and pricing, complex tax structures and delays in tax reporting.

Securities offered through Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, and investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Both are wholly-owned subsidiaries of Cambridge Investment Group, Inc. V.CIR.0425-1623