Markets Cautious After Banking Woes; Awaiting Fed Reaction

Presented by Elsass Financial Group

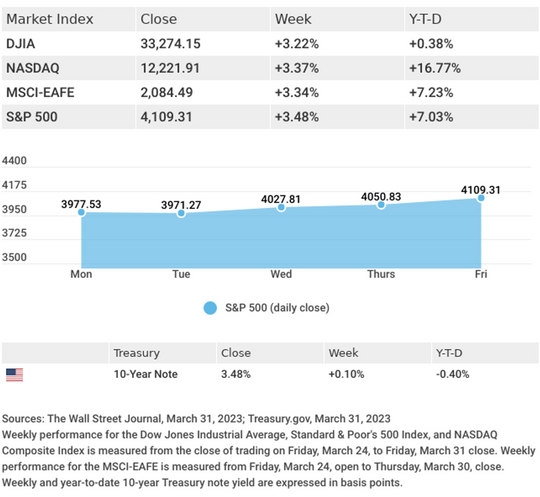

Amid the reverberations of two U.S. banks being taken over by regulators and the spread of uncertainty to European banks, stocks trended higher last week on the strength of the technology sector.

The Dow Jones Industrial Average was flat (-0.15%), while the Standard & Poor’s 500 rose 1.43%. The Nasdaq Composite index picked up 4.41%. The MSCI EAFE index, which tracks developed overseas stock markets, dropped 3.12%.1,2,3

Stocks Gain Despite Banking Woes

Stock prices gyrated as investors wrestled with banking troubles that appeared to spread to Europe. Worries of financial instability rocked financials and sent bond yields falling. While the rush into Treasuries was expected, the dash into technology stocks was a surprise. Falling yields made the high-growth names more attractive, though investors targeted their buying in high-quality companies that offered defensive characteristics, such as profits, healthy cash flows, and strong balance sheets.

When Switzerland’s central bank provided a lifeline to a troubled Swiss bank, and a group of U.S. banks provided aid to a struggling regional bank, stocks powered higher on Thursday. Banking jitters, however, returned on Friday, closing out a tumultuous week and paring some of the week’s gains.

Reverse Psychology

Less than two weeks ago, Fed Chair Jerome Powell testified interest rates might have to be hiked higher and faster. Since then, two U.S. banks were placed in receivership, sparking worries of financial instability and changing the market’s outlook on future rate hikes.

The question now is if the Fed will hike short-term rates at all. By Thursday, traders saw an 18.1% probability of no rate increase at the March Fed meeting, which concludes this Wednesday. Just a week ago, it was a 0% chance. Traders also see a 0% chance of a 50 basis point rate increase in March. A week earlier, there was a 68.3% probability. Where the market previously saw little likelihood of a rate cut this year, the probability of a rate cut by July was 63.7% by Thursday.4

This Week: Key Economic Data

Tuesday: Existing Home Sales.

Wednesday: FOMC Announcement.

Thursday: Jobless Claims. New Home Sales.

Friday: Durable Goods Orders. Purchasing Managers’ Index (PMI) Composite Flash.

Source: Econoday, March 17, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Nike, Inc. (NKE).

Thursday: General Mills, Inc. (GIS), Darden Restaurants, Inc. (DRI).

Source: Zacks, March 17, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Careers aren’t defined by what you say yes to. They’re defined by what you say no to.”

– Brenda Song

5 Things You Can Find on IRS.gov

The IRS website has a wealth of information outside of just tax filing information. Here are some things you can find on the site that might help you as a taxpayer:

- The Taxpayer Bill of Rights – This set of fundamental rights tells you what to expect when dealing with the IRS.

- Resources on how to apply for 501(c)(3) status – There are webinars and resources to help organizations apply for and maintain their tax-exempt status.

- Information on IRS tax volunteer opportunities – Learn how to give back and help people file their taxes.

- Information on the latest tax scams – Know what to look out for and how to stay safe.

- The Interactive Tax Assistant – Get personalized answers to your tax questions.

*This information is not intended to substitute for specific individualized tax advice. We suggest you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov5

Spring Showers Bring… Rainwater Collecting?

We all know the saying, “April showers bring May flowers,” but spring showers also bring an excellent opportunity to collect rainwater! Collecting rainwater is a great way to conserve water, decrease water bills, lower demand for freshwater resources, slow erosion in dry environments, and reduce flooding.

Collecting rainwater at home can be simple. One way is to collect the runoff from your gutter in a bucket or container. You can then use that water for gardening, watering indoor plants, filling the toilet tanks, washing your car, or storing it as emergency water in the case of a fire. While rainwater collection is legal in all 50 states, be aware that some states have restrictions on collecting and using it, so check them before you begin!

Tip adapted from Treehugger.com6

Five girls took part in a bicycle race. Barbara finished before Vicki but behind Susan. Katarina finished before Sara but behind Vicki. In what order did they finish?

Last week’s riddle: You need to park a car for the weekend. You find a parking space marked “2-Hour Parking M-F, 8am-6pm” with no other restrictions. You call the city and find that overnight parking is allowed on this block. So, what is the maximum amount of time you can leave your car in this space without getting a ticket? Answer: 66 hours. You can park from 4pm Friday until 10am Monday.

Spotted leopard at night, Masai Mara National Reserve, Kenya

Spotted leopard at night, Masai Mara National Reserve, Kenya

Footnotes And Sources

1. The Wall Street Journal, March 17, 2023

2. The Wall Street Journal, March 17, 2023

3. The Wall Street Journal, March 17, 2023

4. CME FedWatch Tool, March 16, 2023

5. IRS.gov, September 26, 2022

6. Treehugger, November 8, 2022

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2023 FMG Suite.