What’s My 2022 Tax Bracket?

Presented by Elsass Financial Group

|

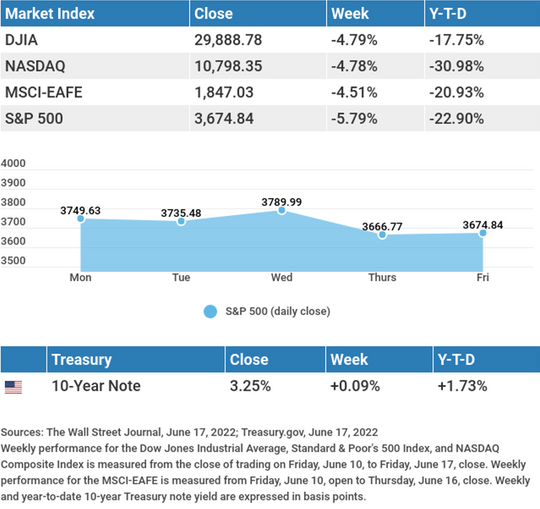

Stocks moved lower last week as recession fears deepened following a Fed hike in interest rates and weak economic data. The Dow Jones Industrial Average fell 4.79%, while the Standard & Poor’s 500 dropped 5.79%. The Nasdaq Composite index slid 4.78% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slumped 4.51%.1,2,3 |

|

|

Stocks TumbleStocks were under pressure all week due to inflation worries, higher yields, and rising recession concerns. In advance of the much-awaited mid-week meeting of the Federal Open Market Committee (FOMC), bond yields jumped, and stocks retreated on speculation that the Fed might raise rates by 75 basis points. When the Fed announced a 75 basis point hike on Wednesday, stocks rebounded strongly. The enthusiasm was short-lived. Stocks resumed their slide on Thursday as global central banks followed with their own rate hikes. Recession fears grew based on a weak housing starts report and a contraction in the Philadelphia Fed Business Index–the first contraction since May 2020.4 Fed Rate HikeThe Federal Reserve announced a 0.75% hike in the federal funds rate, making it the biggest rate increase since 1994 and signaling its commitment to address inflation. The report from last week’s FOMC meeting also indicated new rate projections, showing that all members expect rates to rise to at least 3.0% by year-end, with half the members expecting rates to rise to 3.375%.5 The 75 basis point rate increase was a late-developing change from earlier Fed guidance of a 50 basis point increase. The change of heart was in response to recent inflation data and rising inflationary expectations.6 This Week: Key Economic DataTuesday: Existing Home Sales. Thursday: Jobless Claims. Purchasing Managers’ Index (PMI). Friday: New Home Sales. Consumer Sentiment. Source: Econoday, June 17, 2022 This Week: Companies Reporting EarningsTuesday: Lennar Corporation (LEN). Wednesday: KB Home (KBH). Thursday: FedEx Corporation (FDX), Darden Restaurants, Inc. (DRI). Source: Zacks, June 17, 2022 |

|

|

“In memory everything seems to happen to music.” – Tennessee Williams |

|

Things You Can Do on the IRS WebsiteWhile the IRS website might not be in your top bookmarks, the website is helpful for a lot of things regarding taxes. Here are just a few things you can do on the site:

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional. Tip adapted from IRS.gov7 |

|

Improve Your Swimming with Masters SwimSwimming is a fantastic full-body, low-impact workout for people of all ages. Check out US Masters Swimming for a club near you as the weather warms up! USMS is an organized swimming club for swimmers of all levels. Swimming with a Masters club is a great way to build camaraderie, meet new friends, get better at swimming, and enjoy a great workout. There are clubs all over the country, likely at a pool near you, which you can find through the Club Finder tool on the USMS website. The coaches will help you start (and stick with) a swimming routine, improve your stroke, and learn more about the sport. Tip adapted from US Masters Swimming8 |

|

|

It has 18 legs, is uniformed, walks and runs on grass and artificial turf, and catches flies. What is it? Last week’s riddle: What surrounds everyone and is the end of time and space? Riddle answer: The letter “e.” |

|

|

|

Stepped waterfall group Blue Moon Valley, Lijiang, China |

Footnotes and Sources

2. The Wall Street Journal, June 17, 2022 3. The Wall Street Journal, June 17, 2022 4. CNBC, June 16, 2022 5. The Wall Street Journal, June 15, 2022 6. The Wall Street Journal, June 15, 2022 7. IRS.gov, March 20, 2020 8. usms.org, February 22, 2022 |

|

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite. |

Solve a mystery while learning how important your credit report is with this story-driven interactive.

Presented by Elsass Financial Group

|

A higher-than-expected inflation report triggered a sell-off on Friday, leaving stocks in the red for the week. The Dow Jones Industrial Average lost 4.58%, while the Standard & Poor’s 500 dropped 5.05%. The Nasdaq Composite index slid 5.60% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, declined 1.81%.1,2,3 |

|

|

Inflation Upends StocksStocks gyrated between gains and losses last week until sliding lower on Friday’s hot inflation report, which heightened worries over a more aggressive Fed and a further economic slowdown. Stocks moved higher to begin the week, despite rising bond yields, a profit warning from a major retailer, and Senate testimony by Secretary of Treasury Janet Yellen, who said that inflation was likely to remain elevated. Stocks turned lower later in the week on renewed concerns of an economic slowdown, sparked by a downward revision in The Federal Reserve-Atlanta’s real-time estimate of second-quarter GDP growth and a drop in new mortgage applications. Investors lightening up on stocks ahead of Friday’s inflation report may have also contributed to Thursday’s selling. Inside InflationConsumer prices rose 8.6% year-over-year in May, marking the highest rate since December 1981. Price increases over the last 12 months were driven by a 34.6% jump in energy prices and by food costs, which climbed 10.1%. Used car and truck prices, which had seen three straight months of declines, rose 1.8% from April, while airfares soared 12.6% in May.4 May’s inflation exceeded economists’ forecasts and dashed the hopes that inflation had plateaued. In a separate economic report on Friday, real wages (net of inflation) fell 0.6% in April and were lower by 3% from 12 months ago.5 This Week: Key Economic DataTuesday: Producer Price Index. Wednesday: Retail Sales. FOMC Announcement. Thursday: Jobless Claims. Housing Starts. Friday: Industrial Production. Index of Leading Economic Indicators. Source: Econoday, June 10, 2022 This Week: Companies Reporting EarningsThursday: Adobe, Inc. (ADBE), The Kroger Co. (KR). Source: Zacks, June 10, 2022 |

|

|

“To look back is to relax one’s vigil.” – Bette Davis |

|

A Checklist of Common Errors When Preparing Your Tax ReturnProperly preparing your tax return can be tricky, but here are some tips to help you avoid common errors:

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional. Tip adapted from IRS.gov6 |

|

What is Mindfulness?You may have heard various definitions of mindfulness here and there or have your own ideas about what it is. Do you completely clear your mind? Is there more to it? Interestingly, mindfulness is as simple as it sounds. It refers to the state of being fully present in where you are and what you’re doing. You can practice mindfulness as you’re driving, as you’re walking your dog, or as you’re playing with your children. It’s practicing being in the here and now and not letting your mind take you out of the present moment. These obsessive thoughts can lead to anxiety and stress. To practice mindfulness, take a simple activity, like drinking your cup of coffee, and think about every sensation you’re experiencing. It takes practice but is worth it to improve your mental strength! Tip adapted from Mindful7 |

|

|

What surrounds everyone and is the end of time and space? Last week’s riddle: There is a 5-letter, single-syllable word that you can take 4 letters out of, leaving you with only a single letter that has the same pronunciation as the original 5-letter word. What is this word? (Hint: it involves waiting in line.) Riddle answer: Queue. |

|

|

|

Cheetah gazing into the distance, Namibia, Africa |

Footnotes and Sources

2. The Wall Street Journal, June 10, 2022 3. The Wall Street Journal, June 10, 2022 4. CNBC, June 10, 2022 5. CNBC, June 10, 2022 6. IRS.gov, January 3, 2021 7. Mindful.org, July 8, 2020 |

|

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite. |

Presented by Elsass Financial Group

|

In a holiday-shortened week of volatile trading, stocks surrendered some of the previous week’s strong gains. The Dow Jones Industrial Average fell 0.94%, while the Standard & Poor’s 500 declined 1.20%. The Nasdaq Composite index lost 0.98% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.17%.1,2,3 |

|

|

An Uncertain MarketStocks experienced wild swings last week, in part, due to ongoing uncertainty over economic health and the path of inflation. Investors seemed conflicted when interpreting the data, in some instances viewing economic strength as a negative since it may mean more aggressive rate hikes from the Fed. Illustrative of how this uncertainty has played out, stocks surged higher on Thursday despite comments from Fed Vice Chair Lael Brainard indicating it’s unlikely that the Fed will pause on rate hikes. Then on Friday, stocks dropped as a better-than-expected jobs report raised concerns about monetary policy. Strong Job GrowthThe U.S. economy added 390,000 jobs in May, a slowdown from recent months but higher than consensus estimates. Job gains registered in several categories, led by leisure and hospitality, professional and business services, and warehousing and transportation. The retail sector lost jobs.4 The unemployment rate remained unchanged at 3.6%. Wage growth cooled off, with a 12-month increase of 5.2%, down from April’s year-over-year jump of 5.5%. Finally, the labor participation rate ticked higher again, reflecting how job availability is helping to pull Americans off the labor-market sidelines.5 This Week: Key Economic DataThursday: Jobless Claims. Friday: Consumer Price Index (CPI). Consumer Sentiment. Source: Econoday, June 3, 2022 This Week: Companies Reporting EarningsMonday: Coupa Software, Inc. (COUP). Wednesday: Campbell Soup Company (CPB). Thursday: DocuSign (DOCU). Source: Zacks, June 3, 2022 |

|

|

“I can accept failure. Everyone fails at something. But I can’t accept not trying. Talent wins games, but teamwork and intelligence wins championships.” – Michael Jordan |

|

What To Do if You Didn’t Receive Your W-2If you don’t receive your W-2 or 1099 by January 31 of the year, you are filing taxes, or if the information on these forms is incorrect, contact your employer/payer. If you still haven’t received the forms you need by the end of February, you can contact the IRS at 800-829-1040, and they may be able to help. When you contact the IRS, they will also reach out to the employer/payer for the information you need, and they will also send you Form 4852, which is a substitute for a W-2 or 1099. To do this, they will ask for your employer/payer’s name, address, and phone number (as well as your information). * This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional. Tip adapted from IRS.gov6 |

|

How to Make HummusHummus is a dip made primarily from garbanzo beans and is great on pita bread, veggies, or chicken. Here’s how to make hummus:

Tip adapted from Inspired Taste7 |

|

|

There is a 5-letter, single-syllable word that you can take 4 letters out of, leaving you with only a single letter that has the same pronunciation as the original 5-letter word. What is this word? (Hint: it involves waiting in line.) Last week’s riddle: There are 2 nouns in the English language that become men’s names when you capitalize them – and when you capitalize them, you alter their pronunciation. Name either or both of these 2 nouns, both of which end in ‘b’. Riddle Answer: Herb and Job (herb and job). |

|

|

|

Paragliders above Lake Achen, Tyrol, Austria |

Footnotes and Sources

2. The Wall Street Journal, June 3, 2022 3. The Wall Street Journal, June 3, 2022 4. CNBC, June 3, 2022 5. CNBC, June 3, 2022 6. IRS.gov, January 13, 2021 7. inspiredtaste.net, February 22, 2022 |

|

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. Please consult your financial professional for additional information. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite. |